Many people want the iPhone 17 Pro.Especially iPhone fans.Even in Indonesia.For me, look at the price

The iPhone 17 should find a lot of people.Especially iPhone fans.Also in Indonesia.For me, just looking at the price is scary.ID 23,749,000.This is the official price.It does not include the lay and adjust that is sold now.I can get a hot fever just thinking about it.

Interestingly, it is not a domestic product. The iPhone came from outside. Apple factories from China, India or Vietnam. Everything paid in US dollars. We earn dollars from the export of coal, crude palm oil, nickel, tourism and the sweat of migrant workers.

Now the dollar exchange rate is 16,500.This means that if you want to buy an iPhone that costs 1,500, we should prepare about IDR 24,750,000.But try to imagine if the dollar exchange rate is 5,000.The price of the iPhone will soon drop to IDR 7,500,000.cheapYou can reach more people.

These images definitely tickle me.It makes me think, what if the rupee was that strong?And more importantly, how to achieve it, and then stabilize it in that position.

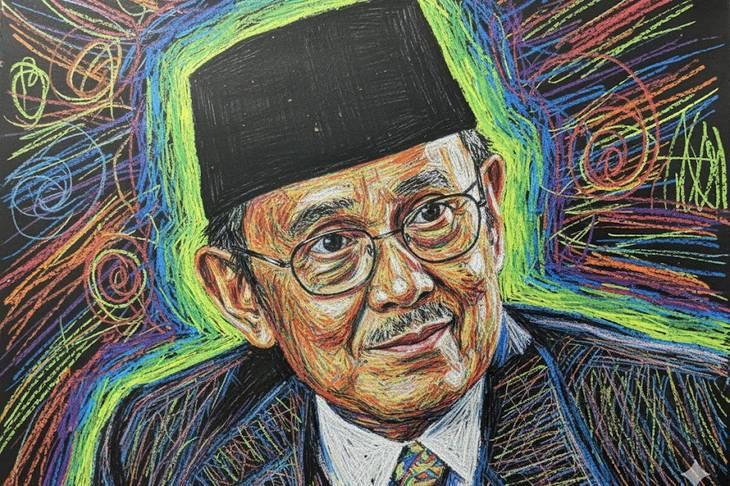

I remember in 1998.At that time, the rupee reached an all-time low of 17,000 to the dollar.The country is being destroyed.Banks are closed, factories are closed, unemployment is everywhere.But B.J. Bibi B.N.After a few months with Habibi, the rupee went from Rp.6500 to IDR 17,000 to 6,500.Magic!

President Habibie took quick and bold steps.He is not an economist, but an aeronautical engineer.He compared the rupee to an airplane that crashed.If it is not controlled, it may fall.So the first thing he did was confirm.Keep the balance so that the plane does not sink further.

On August 21, 1998, Habibie took a major step in restructuring the bank.Weak banks are incorporated into new healthy entities.From there Mandiri Bank was born.He also decided to separate the Bank of Indonesia from the government.Make it an independent institution so it does not put pressure on political power.

The move calmed the market.Investors are starting to believe again.Foreign capital is returning.The exchange rate is strengthening.Inflation, initially close to 78 percent, was successfully brought down to about 2 percent.Habibie did not print money.It creates confidence.

During the rule of Subilo Bambang Yudhoyonono, the rupiah was equal to the RP.9,000 for a dollar. We enjoyed that time for a long time.Economic balance calms people down.Then, twelve years later, the Rupiah is back for Idr 16,500.Touch the numbers of the problem, less.

But the situation is not the same.The dollar is strong around the world.The Japanese yen weakened, the Korean won fell, and even the euro came under pressure.The dollar index (a measure of the dollar's strength against six major global currencies) has now reached its highest level in two decades.This means that not only the rupee is weakening, but also almost all global currencies.

Indonesia's foreign exchange reserves are actually quite large, at around $14.145 billion.Enough to cover imports for more than six months.However, strong foreign reserves do not automatically strengthen the rupee if the current account remains in deficit.Since whenever imports exceed exports, more dollars go out than come in.

A strong rupee cannot stay above consumption.It is strong if supported by productivity.The rupiah gains strength when Indonesia gains strength when selling value-added goods (not raw materials).

ବ୍ୟାଙ୍କ ଇଣ୍ଡୋନେସିଆ ମଧ୍ୟ ଏକ ଦ୍ୱନ୍ଦ୍ୱର ସମ୍ମୁଖୀନ ହୋଇଛି।If interest rates rise, the rupee will become more stable as foreign funds come in looking for returns.

Singapore is a good example.The Singapore dollar is currently one of the strongest currencies in the world.Although the country is small and has no natural resources.But they depend on fiscal discipline and reputation.The government does not limit spending and short-term debt.Every budget is kept so that it runs a surplus, not a deficit.The central bank, the monetary authority of Singapore, carefully monitors inflation and changes

Mereka tidak membiarkan uang beredar seenaknya. Dolar Singapura hanya dicetak jika benar-benar ada cadangan devisa yang menutupinya. Artinya, setiap lembar dolar Singapura mewakili aset riil di luar negeri. Itu yang membuat pasar percaya bahwa nilainya tidak akan jatuh. Ditambah lagi, stabilitas politik dan birokrasi yang efisien membuat investor global menaruh uangnya di Singapura. Ketika modal asing masuk, permintaan terhadap dolar Singapura naik. Nilainya pun menguat.

Switzerland does too.This small country in the middle of Europe makes the Swiss franc a symbol of stability.The government is very cautious in spending.They reject inflation and even fear recession.The Swiss central bank does not disappoint.They also hold gold reserves and foreign assets as a buffer for the currency's value.

The Swiss franc has finally become a haven.When the world economy stagnates, investors move their funds to Switzerland.They believe that the franc will not weaken.So every time there is a global crisis, the Swiss franc actually rises.Legal stability, almost zero corruption and financial order mean that money is trusted all over the world.

Indonesia certainly cannot repeat this.The economic structure is different.Many of our industries are still dependent on imported materials.Every time a new factory is established, the import of machinery and raw materials also increases.So the higher the production, the higher the demand for dollars.Ironically, this is still our biggest homework.

If the rupee is too weak, import costs rise.If too strong, exports lose competitiveness.Therefore, a healthy exchange rate is not a cheap exchange rate, nor is it a stable exchange rate.

Several countries have tried the fast track through denominations.For example, Turkey reduced the pound by 6 coppers in 2005. A million old lira became a new lira.But that's just cosmetic.The value remains the same.The important thing is stability later.Indonesia once had such a conversation, but it was never implemented.Because if the economy is still not strong, the madness will only create new chaos again.in my opinion.

We can even focus on a more realistic exchange rate, for example IDR 10,000 to IDR 10,000, IDR 12,000, IDR 12,000.If exports increase, this can be achieved;losses and inflation will be kept under control.But as a result, our exports will no longer take the form of raw materials.The results will come in, the rupees will come, the rupees will obviously exert force.

However, most of us have exchange rates, not habits.We are very pleased with the imported goods.From mobile phones to shoes, bags and software.Every dollar spent so far is lost in the country.

We must change this habit.Not rejecting foreign products, but being proud of our own products.If we reduce consumer imports a little, the impact will be big.The exchange rate does not disappear quickly.The rupee is more stable.

A strong rupiah is not just about Bank Indonesia.But it is a reflection of the fiscal discipline of the government, the efficiency of the industry and the confidence of the people in their country.

Currently, IDR 5,000 per dollar may be too good to be true.But it is not impossible.Japan once fell from 360 yen to less than 150 yen to the dollar. Korea used to be at 1,800 won, now it's around 1,300.They were able to do this through discipline, hard work and faith in their country.

The exchange rate of 5,000 IDR per dollar is not a target.It is a mirror. A reflection of how strong we are on our feet.

However, wishful thinking is forbidden.Imagine that this morning the exchange rate board wrote IDR 5000. Imagine that you enter an electronic store and see the price for iPhone 17 Pro: IDR 750000,000.

I want to be right.

Check out news, articles and other content on Google News